Consequences of Failing to Settle Obligations with Our Company

Approved Loan Not Withdrawn

If a customer fails to withdraw an approved loan, they are still obligated to make monthly repayments. In such cases, the customer will not only lose the security deposit but will also be required to repay the loan in full through monthly installments. This will be treated as a serious breach of agreement.

Failure to Pay Installments

If a customer fails to pay the required installments, the company will consider this a violation of the loan agreement and an act of fraud. Legal action may be taken, including but not limited to, filing a case in court.

Legal and Financial Consequences

Customers who refuse to settle their debt may face legal enforcement and possible imprisonment under applicable laws. Continued inaction will result in the system permanently freezing the account and marking the customer as having abandoned their financial obligations. Additionally, their account will be blacklisted, and their information will be reported to relevant financial institutions and regulatory bodies.

Blacklist and Credit Impact

All information related to the defaulting customer will be recorded in our company’s internal blacklist database. This may significantly damage the customer’s reputation, credit standing, and future ability to borrow from other financial institutions or lending companies.

List Clients Has Been Blacklisted

Full information of Customer

- Name : MORGUIA MARCELO DELACRUZ

- Job : Create warehouse com

- Loan Purpose : Emergency

- From : Philippines

- Live in : Japan

- Salary : ¥ 170,000 to ¥ 200,000

- Loan amount : 500k 24 months

— Blacklited

- Name : Charllemagne Isip

- Mobile Phone : +393519190130

- Job : Business Owner

- Loan Purpose : Business

- From : Philippines

- Live in : Italy

- Salary : 100,000 PHP

- Loan amount : 3.5M 48 months

— Blacklited

- Name : Esmeralda silva

- Mobile Phone : +972507915562

- Job : Sales lady

- Loan Purpose : Emergency

- From : Philippines

- Live in : Israel

- Salary : 70,000 PHP

- Loan amount : 1M 48 months

— Blacklited

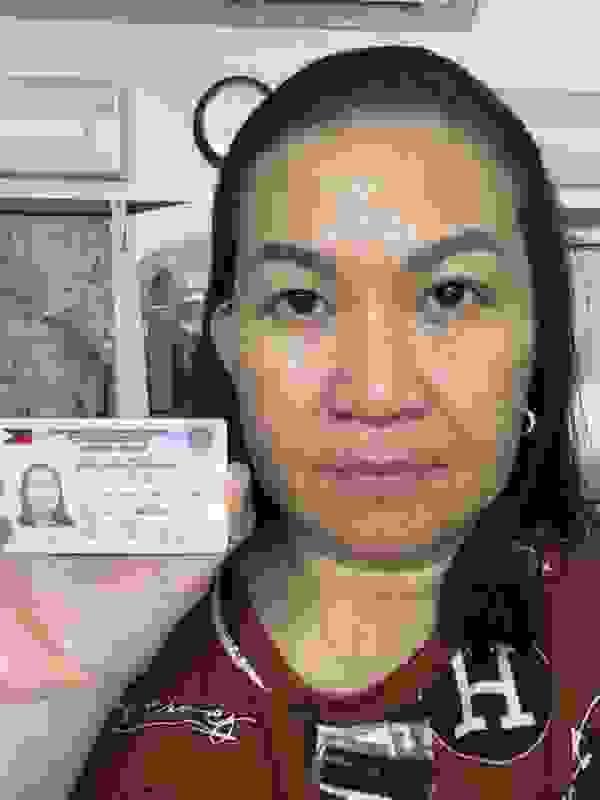

- Name : Michelle Reyes

- Mobile Phone : +639664295387

- Job : Cleaner

- Loan Purpose : House renovation

- From : Philippines

- Live in : Saudi Arabia

- Salary : 81,000 PHP

- Loan amount : 200K and 48 months

— Blacklited

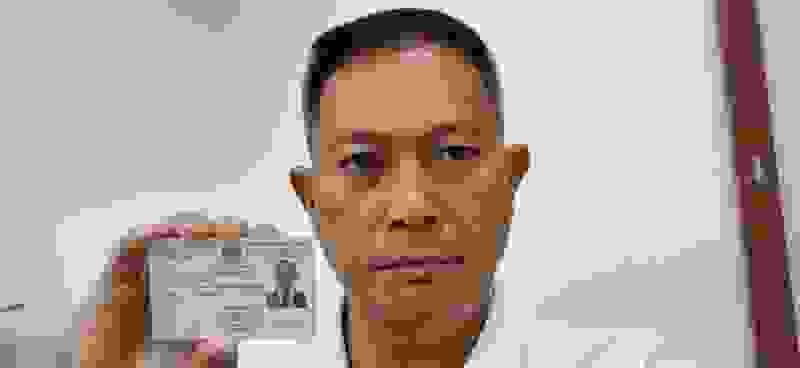

- Name : Roland Jose De Guzman Ledesma

- Mobile Phone : +971508685830

- Job : Supervisor

- Loan Purpose : House renovation

- From : Philippines

- Live in : United Arab Emirates

- Salary : 120,000 PHP

- Loan amount : 550K and 24 months

— Blacklited